Does Insurance Cover Therapy? Your Complete Guide for January 2026

Does Insurance Cover Therapy? January 2026 Guide

Written by:

Arthur MacWaters

Founder, Legion Health

The question “does insurance cover therapy for mental health” comes up often because coverage rules can feel confusing. The good news is that most employer and marketplace plans must include mental health benefits under the Affordable Care Act. What you actually pay depends on your plan’s copay, deductible, and network. This guide walks through how to check your coverage, what costs to expect, and how to use your benefits in a practical way.

TLDR:

Most employer and marketplace plans include mental health benefits under federal parity rules.

You will usually pay a copay after meeting your deductible.

In-network providers generally cost less than out-of-network providers.

Many plans cover telehealth therapy the same way they cover in-person visits.

Legion Health accepts major Texas insurance plans for psychiatric evaluations and medication management.

Understanding Health Insurance Coverage for Mental Health Therapy

For most people, the answer to “does insurance cover therapy” is yes. The Affordable Care Act (ACA) classifies mental health services as one of the required health benefits for most marketplace and employer plans.

Your actual costs depend on your plan details. Variables like copays, annual deductibles, and provider networks shape what you pay at each visit. Checking your summary of benefits is the most reliable way to understand your out-of-pocket expenses.

What the Mental Health Parity Act Means for Your Coverage

The Mental Health Parity and Addiction Equity Act of 2008 prevents many health plans from placing stricter limits on mental health benefits than on medical or surgical care and requires comparable rules for financial obligations like copays and treatment limits.

Recent federal rule updates are strengthening these protections for private health insurers, with individual plans required to comply over the next several years. In practice, many people run into trouble finding available in-network clinicians even when the benefits on paper look similar to medical coverage. Availability and network design often create more friction than the benefit language itself.

How to Check If Your Insurance Covers Therapy

To see how your plan treats therapy, start by logging into your insurance provider’s online portal. Look for sections labeled “Behavioral Health” or “Coverage” to view in-network providers and copay amounts.

Then review your Summary of Benefits. This document outlines your deductible and out-of-pocket costs for specialist visits and is usually available in your portal or enrollment materials.

For the clearest answer, call the member services number on the back of your insurance card. Ask about “outpatient mental health benefits” and confirm your copay or coinsurance rate for therapy visits.

In-Network vs Out-of-Network Therapy

In-network providers have agreements with your insurer to charge contracted rates, so you usually owe only a copay or coinsurance. Out-of-network providers set their own fees, and you often pay the full cost at the visit.

Feature | In-Network | Out-of-Network |

|---|---|---|

Cost to Patient | Lower fixed copay or coinsurance | Full session fee upfront |

Payment Process | Provider bills insurance directly | You pay provider, then seek reimbursement |

Deductibles | Standard annual deductible | Often a separate, higher deductible |

Paperwork | Provider handles claims | You submit superbills |

To use out-of-network benefits, you pay the therapist and submit a document called a superbill to your insurer. Reimbursement depends on your plan and usually requires meeting an out-of-network deductible first. For most people, staying in-network keeps costs more predictable.

Copays, Coinsurance, and Deductibles

Coverage rules differ across employer plans, marketplace plans, Medicare, and Medicaid. Private plans from major insurers like Blue Cross Blue Shield, UnitedHealthcare, and Aetna commonly cover therapy, with PPO plans often allowing direct booking and HMO plans more likely to require a referral.

Medicaid covers mental health services in all states, and Medicare Part B includes outpatient mental health treatment with coinsurance after the deductible. Integrated systems such as Kaiser Permanente often limit coverage to their internal network after an intake assessment.

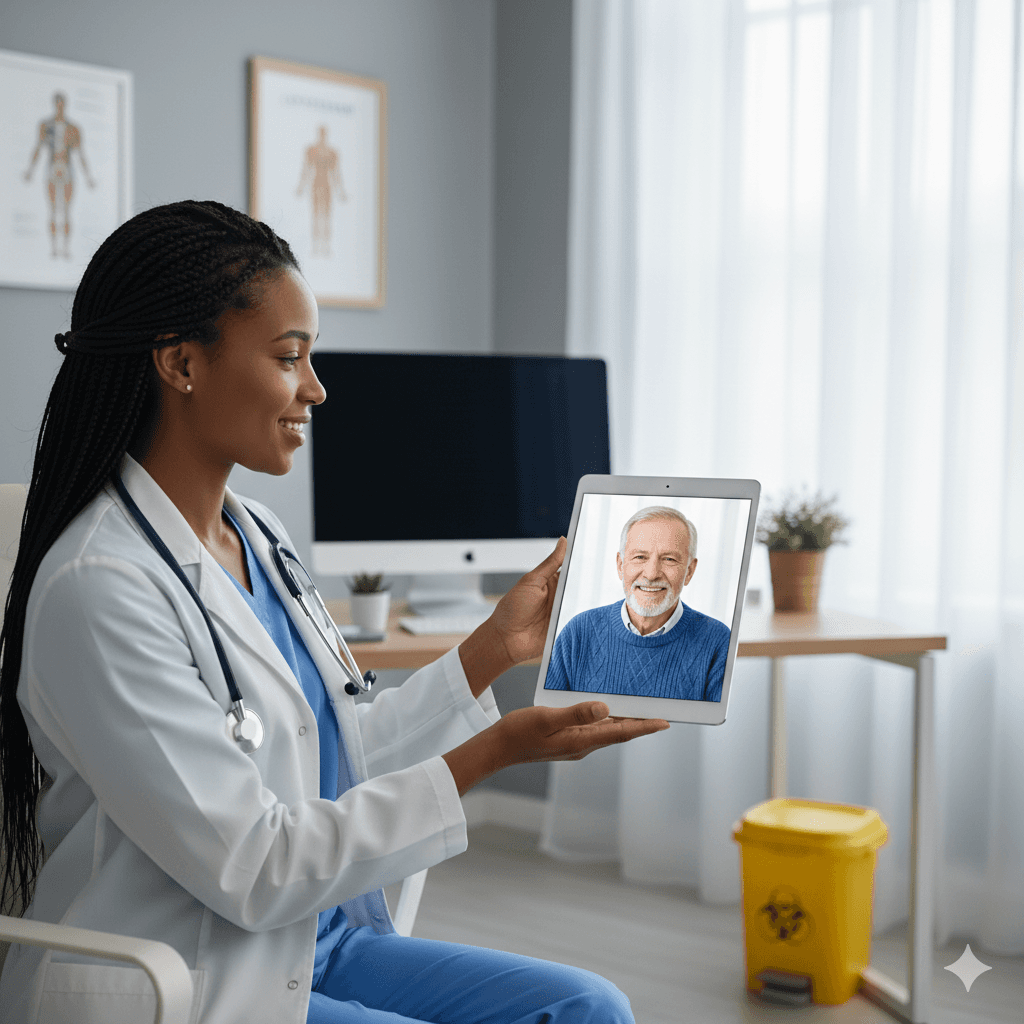

Does Insurance Cover Online Therapy?

For many plans, online therapy is covered in a similar way to in-person therapy. By 2025, over 98 million Americans had access to online therapy benefits through their insurance, with most clients paying around $21 per session with insurance coverage. Major carriers often apply the same copays and coinsurance to telehealth therapy visits as they do to office visits.

Federal telehealth policies have extended key flexibilities for virtual care into 2026, which supports continued access to online mental health treatment across Medicare and many private plans. Coverage for audio-only visits can vary, so it is worth checking your benefits before scheduling.

Common Coverage Rules and Requirements

To qualify for coverage, a clinician usually needs to assign a diagnosis such as anxiety or depression and document that treatment is medically necessary. Services that focus purely on coaching or non-clinical goals often fall outside covered benefits.

Some HMO plans require a referral from a primary care provider for therapy or psychiatry visits. Certain plans also ask for prior authorization, where the insurer reviews the treatment plan before approving ongoing sessions.

Federal parity laws have largely removed strict annual visit caps, but insurers may still review clinical notes after a number of sessions to confirm that continued treatment remains appropriate.

What Types of Therapy and Conditions Are Usually Covered

Most health insurance plans cover therapy when it is used to treat a diagnosed mental health condition that meets medical necessity criteria. Common diagnoses such as anxiety disorders, depression, and PTSD typically qualify.

Plans usually do not pay for services that are framed as life coaching, career counseling, or general personal growth without a clinical diagnosis. Family therapy is often covered when one family member is receiving treatment for a mental health condition, while couples counseling for relationship issues alone is less likely to be reimbursed.

How Many Therapy Sessions Insurance Will Pay For

Because of federal parity rules, many plans no longer publish strict annual limits on the number of therapy sessions. Instead, coverage is tied to medical necessity as documented by your clinician.

In practice, your plan often continues to cover sessions as long as your clinician shows that treatment is helping manage a diagnosed condition and that ongoing care is clinically reasonable. Insurers may review records periodically to confirm this.

What To Do If Your Insurance Denies a Claim

Denials often stem from administrative problems such as coding errors, missing referrals, or incorrect billing information. Your Explanation of Benefits (EOB) usually explains the reason for the denial, which can help you and your provider correct it.

You have the right to appeal. The appeals process usually involves working with your therapist or clinic to resubmit the claim with updated codes or a letter explaining medical necessity. Many denials can be reversed once the underlying issue is fixed.

If coverage remains unavailable, you can ask about Employee Assistance Program (EAP) benefits, sliding scale options, or search for insurance-covered depression treatment platforms that fit your budget.

How Legion Health Fits Into Insurance-Covered Mental Health Care

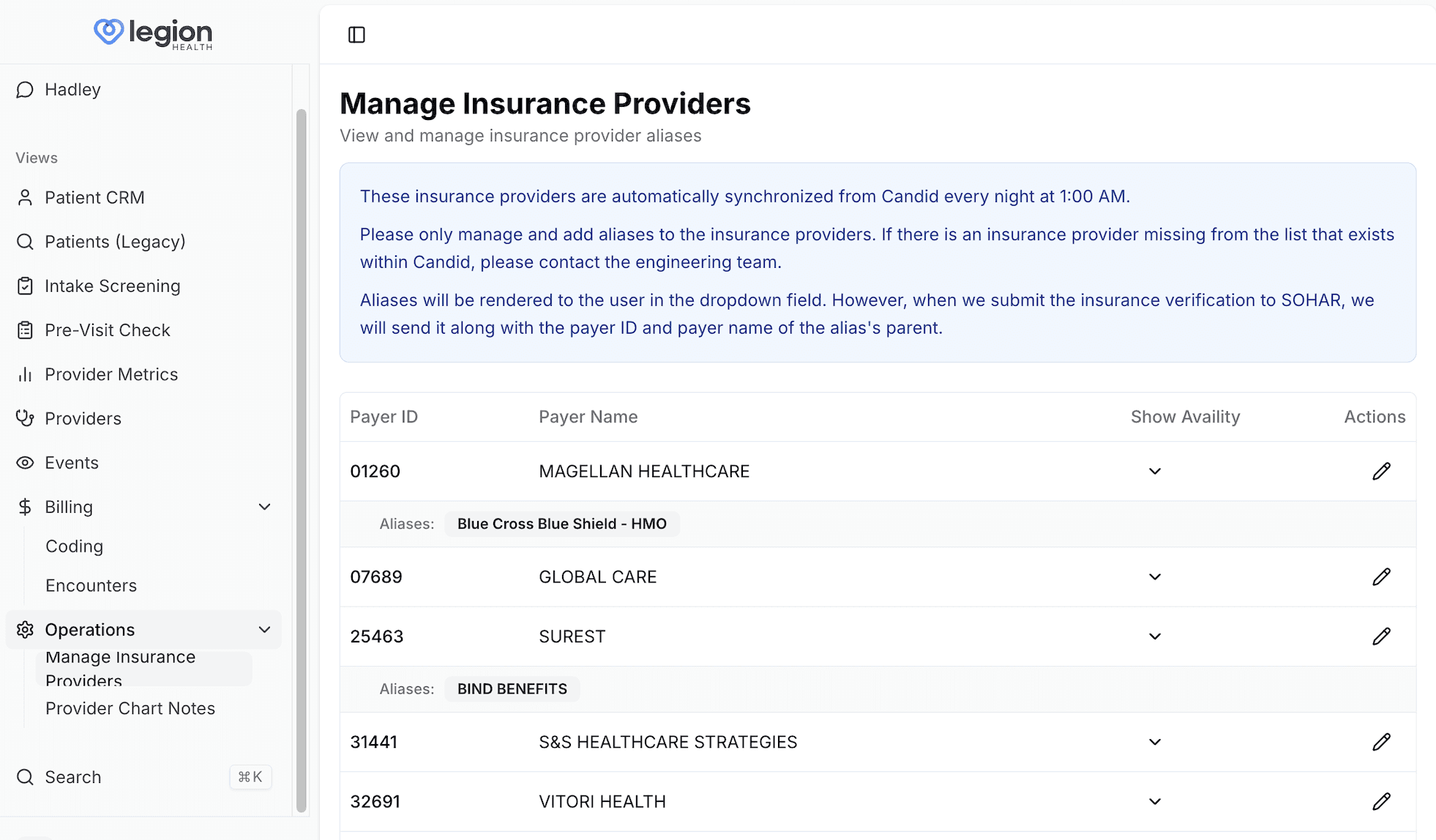

Legion Health is designed to make high-quality psychiatric care more accessible and financially predictable for adults in Texas. The clinic accepts most major commercial insurance plans, including Blue Cross Blue Shield, UnitedHealthcare, Aetna, and Cigna.

Because many people need more than counseling alone, Legion focuses on psychiatric evaluations, medication management, and structured follow-ups. The team handles most of the administrative work such as benefits checks and cost explanations so you are not left guessing about bills or next steps.

If you are seeking support for anxiety, depression, ADHD, or other outpatient mental health needs, Legion offers a virtual, insurance-friendly path that is built around safety, clarity, and longitudinal care.

If you want a clearer plan for your symptoms and prefer clinician-led, insurance-friendly care, you can see whether Legion Health is a fit and schedule your first visit.

Final Thoughts on Therapy Coverage and Next Steps

Insurance coverage for therapy is common, but your actual benefits depend on your specific plan and network. Reviewing your benefits summary and calling member services are the most reliable ways to understand your costs. If you want psychiatric care in Texas that works with major insurance plans, Legion Health verifies coverage at the start of care and focuses on psychiatric evaluations and medication management visits.

FAQs

Does my insurance plan cover therapy sessions?

Most employer-sponsored and marketplace health plans cover therapy as a health benefit under the Affordable Care Act, but your actual costs depend on your specific plan's copay, deductible, and provider network.

What's the difference between seeing an in-network therapist versus an out-of-network provider?

In-network providers charge fixed rates negotiated with your insurer, so you typically pay only a copay or coinsurance, while out-of-network providers require you to pay the full session fee upfront and submit claims yourself for partial reimbursement.

How do I find out what my copay will be for therapy visits?

Log into your insurance portal and look for "Behavioral Health" or "Coverage" sections, review your Summary of Benefits document, or call the member services number on your insurance card and ask about "outpatient mental health benefits."

Does insurance cover online therapy the same way it covers in-person sessions?

Most major carriers handle telehealth therapy sessions with the same copay structure as in-person visits, though coverage for audio-only sessions can vary by plan, so verify your specific benefits before scheduling.

Will my insurance limit how many therapy sessions I can attend each year?

Federal parity laws have removed hard annual caps on therapy visits for most plans, but insurers may review your treatment records periodically to confirm that ongoing care remains medically necessary based on your diagnosis and progress.

We're honored to support thousands on their journeys. Here's what some have shared: